November 18, 2025

AI has brought several developments in AI this year. Looking ahead to 2026 we anticipate that this may only be the tip of the iceberg…

AI has brought several developments in AI this year. Looking ahead to 2026 we anticipate that this may only be the tip of the iceberg…

A significant player and for many a go-to option for text and answer generation, Claude has been doing a great job of offering unique integrations with tools. However, as investments start to pour into Google, OpenAI and Microsoft there is a risk that it may fall behind these big players.

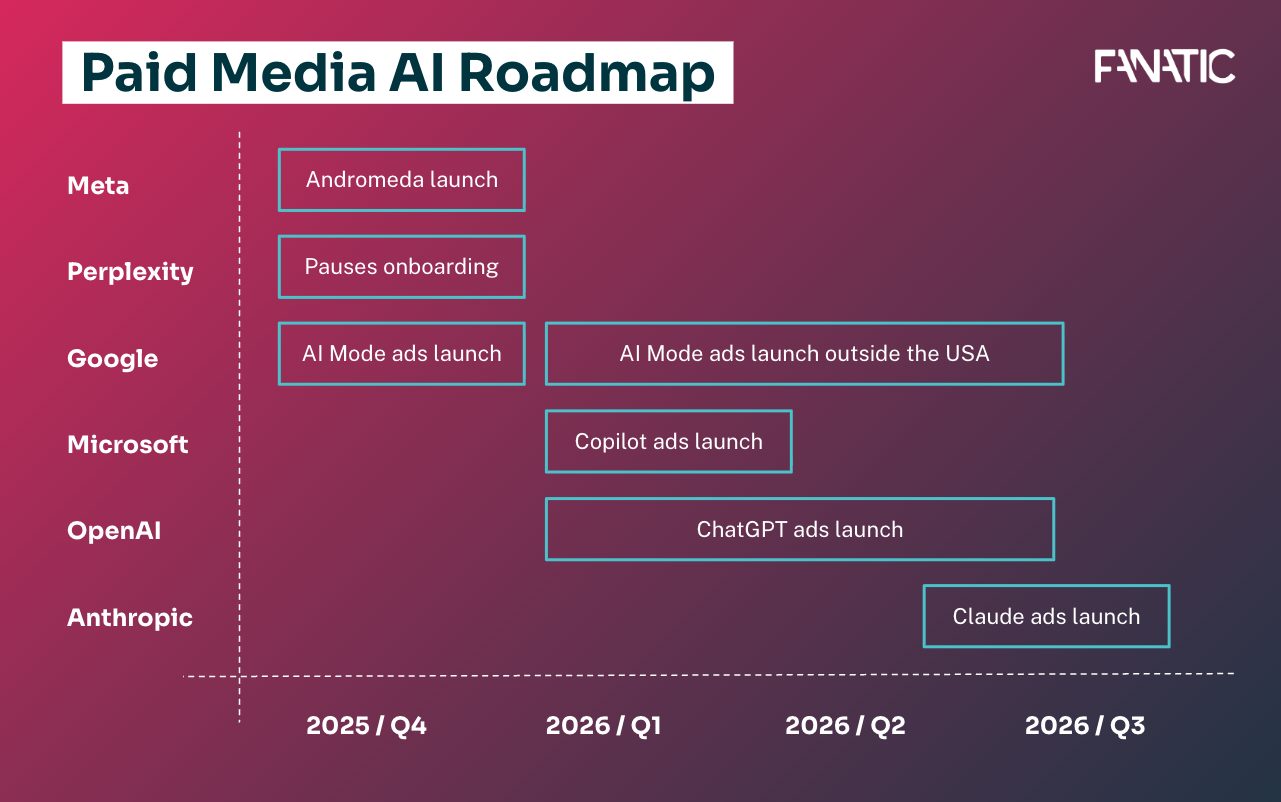

Ads have been released as part of the development roadmap for Claude, with a target live-date of mid-2026. However, nine months is a long way away and is a lifetime in the current pace of change of AI.

Though maybe one of the less popular LLMs currently on the market, Perplexity’s independence has given them the freedom to launch new features more quickly than Google or Meta. Alongside Anthropic’s Claude LLM, Perplexity has been tied up in court with Reddit over plagiarism claims. This case, sitting in a grey area, may have broad implications for the way AI scrapes and references external content when it is settled

Perplexity was the first LLM agent interface to implement a digital ads offering to support the ongoing goal of monetising the platform. Early results were positive with low volumes but high-converting, high-value leads being generated.

As of Q4 however, Perplexity is no longer open to new advertiser registrations, stating a whole reassessment of its advertising offering and that the ad network is not currently planned to extend to Comet, Perplexity’s own browser.

That’s quite a shift from leading the AI roadmap, but it does highlight that AI search and its monetisation is still a brand new frontier for tech businesses.

Overall, Microsoft’s AI rollout and sophistication in the agent space have lagged behind the other big players, with Copilot typically following behind ChatGPT and Google’s Gemini. However, Microsoft’s dominance of the business tool space and ability to preinstall the software in new PCs give it a distinct commercial advantage in terms of user adoption. This does not necessarily extend to the search or agent-based AI space, though.

That being said, although Bing search ads generally have a smaller audience than Google, campaigns for niche B2B audiences can work very well. With Edge being the default browser for users within large organisations, there is a strong case for a Copilot-based browser being one of the top 3 AI tools in the working environment..

Copilot ads have already been teased, with a rollout to English-speaking markets currently in the timeline for March 2026. However, there has been a lot of backlash around the formatting and placement of ads on Co-Pilot, which may be impactful for advertisers at the cost of driving away users.

Microsoft have recently become the owner of 27% of the for-profit part of OpenAI. This raises interesting opportunities for a combined development process between Microsoft and AI, which could combine the strengths of both platforms.

Meta’s relationship with AI has been quite mixed over the past few years. After a number of underwhelming product launches in the form of the Metaverse and Threads, over 600 employees were let go in October 2025 after the latest round of work on Meta’s Llama LLM proved woefully short of expectations. Since then, Meta has been exploring more options to partner with existing LLMs rather than developing their own.

Although from a customer-facing perspective, Meta doesn’t have as many tools as most of the competitors on this list, it does seem to have pushed further ahead with AI tools for advertisers.

Andromeda is the most recent release from Meta, Described in Meta’s own terms as “A personalized ads retrieval engine that leverages the NVIDIA Grace Hopper Superchip, to enable cutting edge innovation in the Ads retrieval stage to drive efficiency and advertiser performance.”

You can read all about how it’s going to impact advertisers here.

With a staggeringly large percentage of users starting their customer journey with a Google search, Google was always going to be a huge player in the AI arms race for customers and advertisers. Google AI was originally launched in 2017 with many of its earlier machine learning models supporting advertisers and searchers alike for the last decade.

Offering arguably the broadest range of surfaces for AI interaction across Drive, Gmail, Search, Chrome, Cloud and its developer and marketing suite, Google has a huge advantage in terms of data and existing customers. If anything, it’s been a victim of its own success, as it recently had to reduce the number of search results shown to stop competitors from crawling its results to power their own LLMs.

Performance Max started the trend of taking more of the decision-making away from advertisers and putting it into the hands of Google’s machine learning and AI models. AIMax took this even further, but as we discussed in our “race to the middle” article, this has been great for inexperienced businesses to get ads live, but has done little to improve the performance of dedicated search campaigns.

The same text ads as we’ve been looking at for almost 25 years (albeit with a few changes) are available to show alongside AI overviews on search pages. AI mode ads are coming to the US in Q4 of 2025, and Gemini native ads have been discussed for at least the last 10 months.

Due to high-profile press coverage, OpenAI needs little introduction. The part ownership by Microsoft does have the potential to change the trajectory of a company that most would have called an outlier a few years ago.

2026 is going to be a huge year for them, as ChatGPT ads have already been announced for the first half of the year, as has the first AI PayPal integration, making it a standout option for e-commerce businesses.

Despite there being no preview of how the ads might look, the eCommerce and product cards already deployed give a strong indicator. Our advice is to start looking at your product feeds as they will likely have a strong part to play.

A big question to address is whether, ultimately, people will need to go to openai.com in the first place. The rise of the AI browser, with Chrome being AI-enabled by default, Atlas and Comet launching, with more planned releases in 2026, hints at the future browsing experience.

Why bother visiting a webpage when your browser does it all anyway? We might see a change where browsers effectively become a new placement available in your ad network.

With variety in the formats, targeting and metrics available across different platforms, CPM has been cited as a potential payment model for many AI agent ads. This may mean another step backwards in terms of ROAS transparency in the short term.

There is simply not enough data in the market for even the big players to make promises about cost-per-click models.

There is a well-known saying, “May you live in interesting times…” and for advertisers, this is certainly true. While we can’t be certain exactly how things will develop in the next year (we’re humans and not AI after all), we will definitely continue to keep on top of the latest developments.

As a final, bold prediction, we believe there is a strong possibility that one of the key AI players will either fail or fold next year. With so much competition and so much to play for financially, the high stakes can lead to big losers.